Private label has long been the go-to option for consumers wanting the most value for their money, but in recent years that image has shifted to be more and more of a premium offering. New lines like Good & Gather from Target have shown that shoppers are willing to forego their brand loyalty when the value is sufficient – and, it doesn’t hurt when the product is even high-quality. These new “premium” products, available at national brand prices – or above, in some cases – are signs of a healthy level of earned consumer trust.

Raley’s Degrees of Value

National brands at the grocery store are recognizable, but they don’t necessarily offer the best value. By developing more and varied “store brands,” retailers have made it easier to choose savings over branding. For example, Raley’s renovated its private label lineup in 2019 to better suit consumers’ needs; instead of a single line of store brand products, the new system is tiered based on affordability and product quality.

To date, Raley’s carry three owned-label brands:

- Nob Hill Trading Co., an ultra-premium label with the tagline “Experience Exquisite Artisan Flavor For Less.” which includes gourmet products with global and local influences.

- Raley’s Purely Made, an assortment of products that focuses on increased transparency and freshness.

- Raley’s, the standard store brand with everyday essentials and pantry staples.

In particular, the Purely Made brand is part of an industry-wide move towards fresher ingredients, less preservatives, and clear communication between retailers and consumers.

Raley’s Purely Made products are free from 101+ artificial preservatives and ingredients. Raley’s utilized the most up-to-date research and industry standards to update their banned ingredient list….Purely Made standards extend beyond packaged goods to fresh items like meat, seafood and produce. Purely Made produce is organic, while meats and center store items are organic when possible.

Press Release, “Raley’s Relaunches Private Label Program with New Design & Greater Transparency”

Target’s Good & Gather

Whereas Raley’s private label initiatives are an evolution of their existing brands, Target has taken their premium private label a step further by replacing their Archer Farms label with Good & Gather.

The Good & Gather line was introduced into stores on September 15, 2019, touting products made without artificial flavors and sweeteners, synthetic colors, or high fructose corn syrup. Organic options, vibrant photos, and slick packaging made it clear that these items weren’t there to compete with national brands, but instead offer premium food choices to consumers.

“Our guests are incredibly busy and want great-tasting food they can feel good about feeding their families,” commented Stephanie Lundquist, Executive Vice President, Food & Beverage. “We saw this as a huge opportunity for Target to help. So our team got to work on our most ambitious food undertaking yet, reimagining our owned food brands to serve up convenient, affordable options that do not cut corners on quality or taste. Good & Gather is our way of helping even the most time-strapped families discover the everyday joy of food.”

AndNowUKnow, “Target Introduces Its Newest Brand, Good & Gather”

When the line was announced at GroceryShop 2019, the Good & Gather brand made a guarantee to consumers: “Love every bite or bring it back.” Like Raley’s Purely Made, Target’s private label line hones in on the trust that shoppers place in retailers–by doing away with unwanted ingredients, these premium offerings promise quality and peace of mind. Target is set to complete its assortment of 2,000 Good & Gather products this fall.

Premium Tier Growth

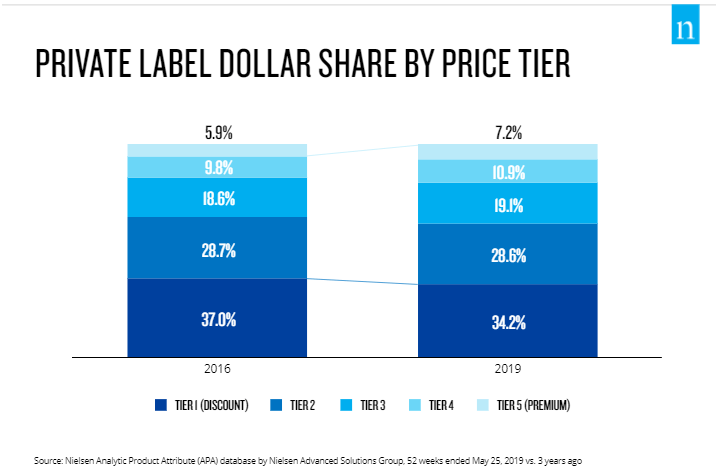

The dollar share of premium private label has also been growing in comparison to discount and mid-tier products, based on recent data. In 2019, discount private label dropped to 34.2% of dollar share, down from 37% of share in 2016. At the same time, Tier 3, Tier 4, and Premium private label all grew in dollar share.

It is worth noting that these analyses took place before Target’s Good & Gather line launched. More recent data shows that this upward trend skyrocketed in 2020, with Target reporting increases in food and beverage own-brand sales.

This fall, we’ll roll out the third and final phase of our Good & Gather assortment, adding more than 600 items to bring the total number of items to nearly 2,000. The Good & Gather brand is clearly resonating with our guests and delivering on our food and beverage vision….With the momentum from this new brand, our own-brand food and beverage business has been growing more than 30% so far this year, significantly outpacing the market and growing market share.

Brian Cornell, Target CEO, 2020 Target Q2 Earnings Call

Lasting Impressions

Private label, and especially premium own-brands, allows retailers to interact with consumers outside of the store. Whether it’s through health initiatives and cleaner ingredients or just by occupying space in shoppers’ pantries, a premium private label product builds trust and reinforces the retailer’s value proposition. In the time of the pandemic, the need for private label is especially apparent. Brick Meets Click, along with Mercatus, surveyed households to discover their private label shopping behaviors and found significant increases in Private Label purchases.

The combination of economic instability, greater focus of ingredient transparency, and stronger initiatives to impact consumer health have all contributed to growth for private label that has culminated in 2020 sales growth.

For more information on the impact of private label on price perception, you can read our blog on The Hidden Price War here. For more data and insights into changing consumer behavior in the pandemic, you can watch our expert discussion with Brick Meets Click and Nielsen leaders here.