According to the latest Consumer Price Index from the Bureau of Labor Statistics prices increased +8.3% year over year. This was higher than many had predicted and was driven by a record increase in the Food At-Home sub-category. Shoppers continue to face rapidly rising everyday prices and a continued decrease in promotion frequency. During times of high inflation shoppers turn to a handful of retailers with well known value equations. The retailers that are keeping prices down the most year to date are not who you might expect however.

Promotion Frequency Declines but Promotions are Getting More Aggressive

Prior to the Covid pandemic nearly 1 out of every 3 units sold was on promotion. Recent research indicates that this figure has declined to just 27% in August. Promotion frequency continues to trend down year over year, but promotion depth is slowly increasing again.

Promotion Depth is increasing in General Merchandise as retailers clear out inventory, as well as in many center store food and home categories. Pet, Candy, Soda, Hair Care and Dental are among the categories with the greatest increase in promotion depths vs. prior year.

Food Price Increases Now Leading the Total Store

For much of the Summer Frozen prices were rising the fastest across the store. Food has now overtaken Frozen with prices up nearly 20%. Food price increases are across most categories and driven by promotion frequency reductions and everyday price increases. Most Food categories are seeing 5-10% reductions in promotion frequency which are only partially offset by small depth of discount increases. In addition to the decline in promotion support Food prices are driven higher by significant increases in everyday prices.

Shifting Retailer Landscape

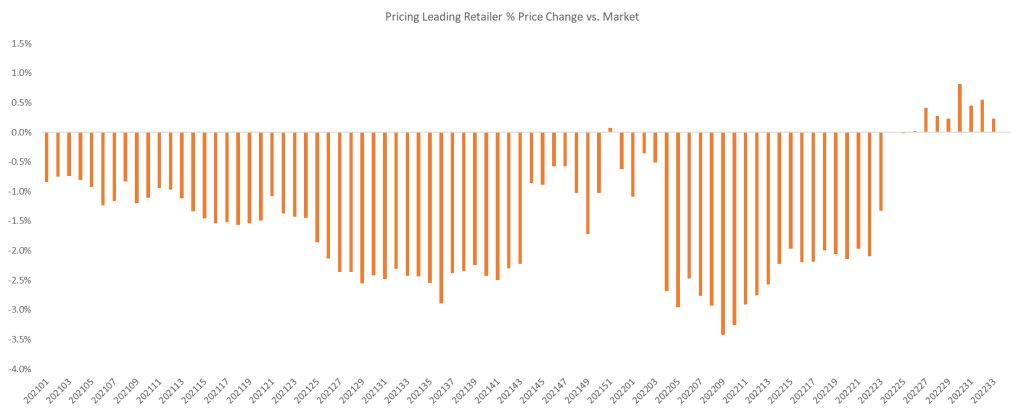

Throughout the early part of the pandemic traditional high-low retailers saw their price position significantly worsen. Year to date many of these high-low retailers are now regaining some of this lost ground. While their price position is still worse vs. prior to the pandemic, the return of promotions has made high-low retailers more attractive. Smaller/independent and regional retailers are still facing the brunt of price increases as they have lost significant ground vs. 2020 and are increasing prices faster year to date than the market.

We are also observing a big shift in the retailer that is improving their price position the most. In the last few weeks the retailer that most significantly improved their price position in 2020 & 2021 is now closely tracking the market and seeing their price position slightly worsen.

Given the dynamic inflation environment it is critical for retailers and brands to have quality pricing data. Engage3 helps over 25% of the INC. 500 fastest growing brands and 6 of the top 10 retailers track their price position. Engage3 data ensures that you know how your competitors are moving price. This information helps you to increase your margins, accelerate revenue growth and drive trips. Want to know how your prices compare and see who is winning in your market? Reach out to Engage3 for a demo and free report on pricing in your market and/or category.